Excise Duty

We express excise duty rates per litre of alcohol LAL for alcoholic products. Excise duty charges are also collected by state governments for alcohol and narcotics.

Electronic equipment and cosmetics.

Excise duty. The CPI indexation factor for rates from 2 August 2021 is 1014. Except for distilled spirits and beverages. The excise tax is the indirect tax that is charged as per the Excise Duty.

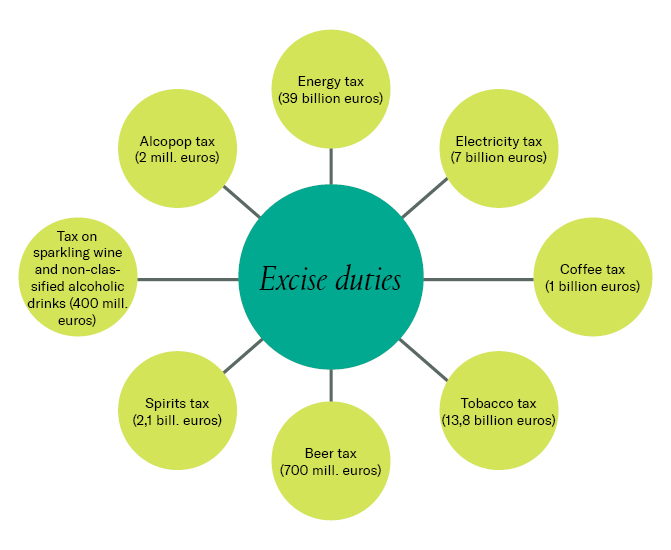

Check if an excise duty number is valid. And the duty that is levied on goods imported from a foreign country is the customs duty. EU excise duty rules cover alcohol alcoholic drinks tobacco energy products electricity.

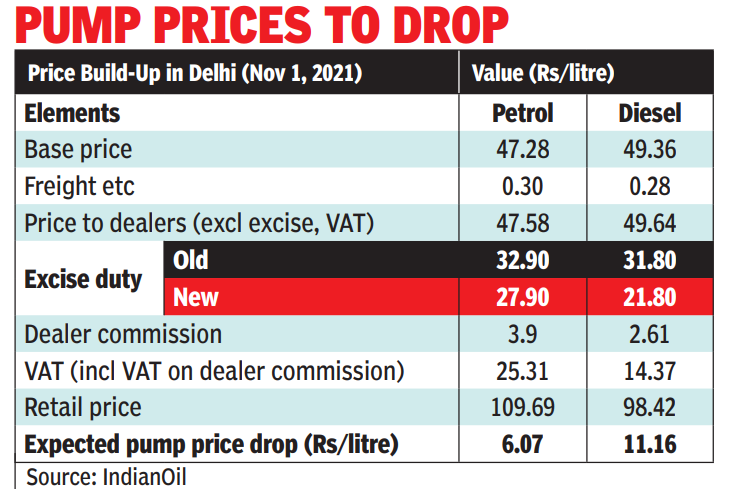

Excise duty is a form of tax imposed on goods for their production licensing and sale. The primary function of these duties and levies is to ensure a. Government of India has taken a significant decision of reducing Central Excise Duty on petrol and diesel by Rs 5 and Rs 10 pre litre respectively from tomorrow.

Higher fuel taxes helped boost central excise duty collections that jumped 33 year-on-year to Rs 172 lakh crore during April-September. When looking at the price of goods excise duty forms its major portion. Excise duty is generally a central levy but not all levies are raised by the centre.

EU rules explain which products are subject to excise duties and how the duties must be applied to them. The duty that is levied for goods manufactured inside the state can be called as excise duty. Excise duty refers to the taxes levied on the manufacture of goods within the country as opposed to custom duty that is levied on goods coming from outside the country.

Minimum excise duty equivalent to 57 of the retail selling price and minimum excise duty of EUR 60 per 1000 cigarettes of the category most in demand. We index the excise duty rates for alcohol twice a year in line with the consumer price index CPI. 10 respectively from tomorrow.

Consequently petrol and diesel are set to become cheaper. Excise duty is valued ad valoreum which means that the duty is calculated taking into. Excise duty as a percentage of retail price will fall from 323 to 221 for diesel after the excise duty cut.

Excise duty is a form of indirect tax that is levied by the Central Government of India for the production sale or license of certain goods. Excise duty on Petrol and Diesel to be reduced by Rs. Implementation of the excise duty rates on cigarettes and other tobacco products until 31 December 2006.

An excise duty is a type of tax charged on goods produced within the country as opposed to customs duties charged on goods from outside the. Readers should note that GST has now subsumed a number of indirect taxes including excise duty. Excise duty is imposed along with VAT and sales tax.

An indirect tax paid to the Government of India by producers of goods excise duty is the opposite of Customs duty in that it applies to goods manufactured domestically in the country while Customs is levied on those coming from outside of the country. Global crude oil prices gained 587 in 2021 supported by vaccination-led demand revival weak. Items charged under specific rates include.

Excise duty on alcohol alcoholic preparations and narcotic substances is collected by the State Government and is called State Excise duty. EU law also stipulates the minimum excise duty rates to be applied although each EU country. Minimum excise duty of EUR 64 per 1000 cigarettes of the category most in demand and a derogation to continue to apply its excise duty.

The excise duty reduction is effective from November 4 when petrol price will come down from the current rate of Rs 11004 a litre in Delhi to Rs 10504. Government announces Excise Duty reduction on Petrol and Diesel on the eve of Diwali. Excise duties and levies are imposed mostly on high-volume daily consumable products eg.

For most of the states excise duty is the second largest tax revenue after. Excise Duty is a duty charged on specific goods and services manufactured locally or imported on varying rates. Generally indexation occurs on 1 February and 1 August.

Excise duty on production of few items including that on liquor is imposed by state governments. These goods may be either of UK origin received in the UK following an intra EU. Excise duty is chargeable in addition to any customs duty which may be due on the goods described in this part.

Excise duty on petrol has been reduced by Rs 5 and that on diesel has been cut by Rs 10 the Centre said in an official release. Excise duties are indirect taxes on the sale or use of specific products such as alcohol tobacco and energy. Find out how to pay and how to get excise duties reimbursed.

A tax on some types of goods such as alcohol cigarettes or petrol paid to a national or state. The revenue from these excise duties goes entirely to the country to which they are paid. Excise duties are indirect taxes applied to the sale or use of goods such as alcohol tobacco and energy products.

Special excise rules when selling online. This tax is not paid directly by the customer but is passed on to the consumer by a merchant or producer of goods as a part of the price of the product. Diesel rate will be reduced from Rs 9842 per litre to Rs 8842.

An excise duty is a type of indirect tax that is levied on the sales of particular goods. Petroleum and alcohol and tobacco products as well as certain non-essential or luxury items eg. Excise duty reduced rates and exemptions.

For petrol that will reduce from 30 to 254. Until 31 December 2007. Excise duty an INDIRECT TAX imposed by the government on a product principally those such as tobacco petrol and alcoholic drinks the demand for which is highly price-inelastic see ELASTICITY OF DEMANDGovernments use excise duties both as a means of raising revenue see BUDGET and as an instrument of FISCAL POLICYSee CUSTOMS AND EXCISE.

It is charged in both specific and ad valorem rates. The excise duty rates may also change as a result of law changes. Wine spirits beer soft drinks mineral water fruit juices Recorded DVDVCDCD and audio tapes cigarettes tobacco petroleum products and Natural gas.

24 January 2020 Excise DutyLevy submission and payment dates for 2020 and 2021.

What Is Union Excise Duty The Financial Express

10 Excise Duty Tax On Branded Garments Excise Duty On Branded Apparel Fibre2fashion

What Is Excise Duty And When Is It Payable Velta

Excise Duties Regulations Greenlane

What Is Excise Duty Excise Duty Definition Excise Duty News

What Is Vehicle Excise Duty Osv

Excise Duty Consultancy Service Service Provider From Varanasi

Excise Duty On Bank Open Tax And Legal Consultants Facebook

Excise Duty Neo Ias Current Affairs Plus

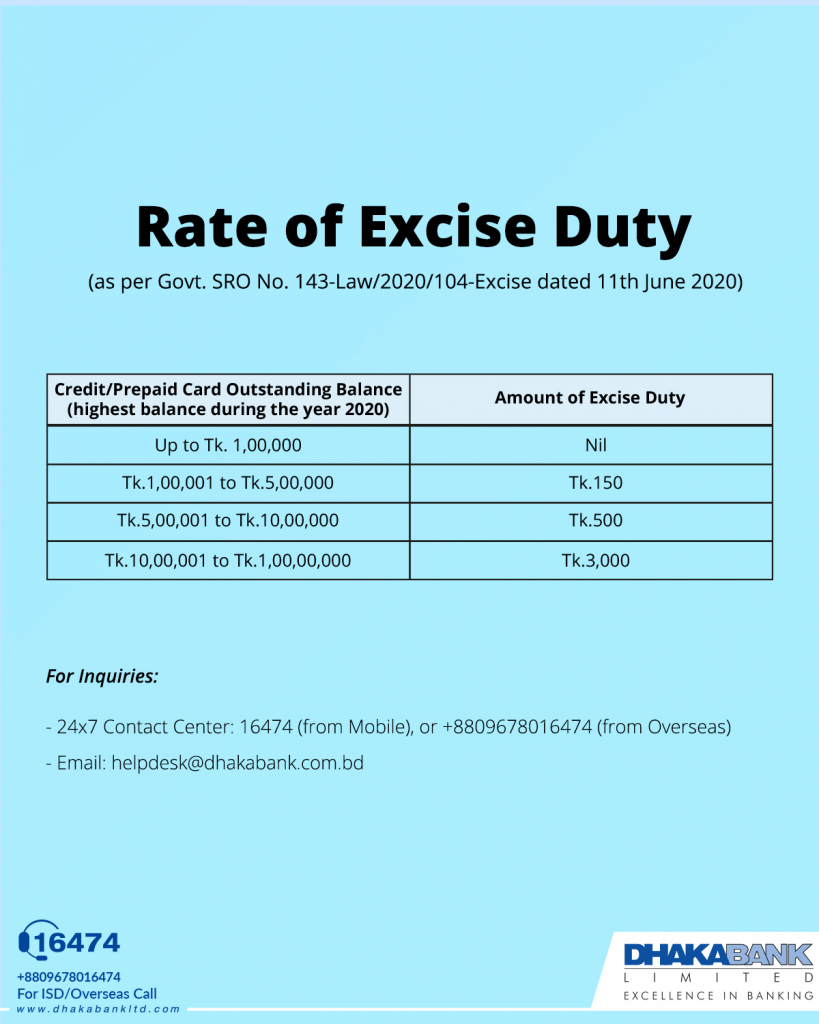

Rate Of Excise Duty Dhaka Bank Excellence In Banking

Budget 2018 What Is Excise Duty Lifeberrys Com

What Is Excise Duty Excise Duty Definition Excise Duty News

What Is Excise Definition And Examples Market Business News

What Is Excise Duty Tax Types Of Excise Duty In India Calculation Of Excise Tax

Difference Between Income Tax And Excise Duty Diferr